How SMED Affects Competitiveness

The Implications for Strategy

In A Nutshell

Why Setup Reduction is the key to small lot production and how the ability to build small lots affects marketing, business and financial strategy.

Effects of Setup Reduction (SMED)

The discussion, so far, assumes that setup costs are fixed. Setup Reduction can often bring setup cost and thereby lot sizes down by a huge percentage. . See the following pages for more on how this is done:

Printing Press Make-Ready (76% Reduction)

Setup reduction (SMED) has somewhat different effects on Make-To-Order (MTO) and Make-To-Stock (MTS) environments:

Make-To-Stock

- Reduced Optimum Lot Size

- Broader Range of Lot Sizes

- Lower Total Cost Curve

- Fewer Stockouts

- Lower Inventory

Make-To-Order

- Lower Minimum Order Sizes

- Higher Margins on Larger Orders

- Faster Deliveries

Make-To-Stock Example

Make-To-Stock Original Setup

In this analysis, an MTS machined part shows an optimum lot size of 200 units at a minimum Total Cost of $5.775.

However, the costs used in this analysis are inexact by nature. Particularly the storage costs that are usually elusive, part of overhead and must be allocated by an inexact formula. In addition, there are many benefits in small lots that have not been captured by this analysis. Recognizing these inaccuracies, we might allow a tolerance on the total cost of, say, 3% and this is very conservative.

With a 3% tolerance there is a range of lot sizes available from 110 pieces up to 450 pieces. Given the advantages of small lots, the analysis would now indicate an optimum lot size of about 110 units.

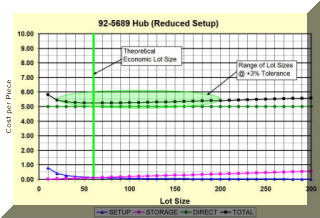

Make-To-Stock Reduced Setup

With a 90% reduction in setup cost, the optimum batch becomes 20 units. Using a 3% deviation from optimum, the range becomes 20-200 units.

Implications of This Analysis

If the original ELS is taken at face value (200 units) the minimum average inventory would be 100 units. However uncertainty of demand and other variations would dictate a much larger average inventory.

With setup reduction the ELS is only 60 units. If this ELS is taken at face value, average minimum inventory would drop by 70%. However, the range of lot sizes has increased greatly and this leads to even more flexibility. Lot sizes from 20-200 units are now feasible.

Taking the minimum lot sizes from the range both before and after setup reduction (110 and 20) the inventory reduction would be 80%.

One highly important but intangible benefit is the reduction of stockouts. For companies that deliver from stock, a stockout represents more than just a lost sale. It can also lose customers and affect many possible future sales.

In the short term, these kinds of improvements represent localized cost savings. In the longer term, extended to other products, they can have major positive effects for facility, finance and marketing strategies. They can increase growth while providing the capital and space required for that growth.

Make-To-Order Example

Make-To-Order Original Setup

In an MTO situation, there is essentially no finished good storage. This analysis also assumes no raw materials or WIP storage, although these can be significant in many factories. The result is that there is no "optimum" lot size unless we take the customer's order as the optimum.

The issue for MTO is the effect that setup costs have on pricing, volume discounts and/or profits. With very large orders the setup cost is amortized over so many units that the total cost approaches the direct cost as shown in the chart above.

When customers want only a few items on an order the setup cost adds significantly to production cost. This requires either a price increase or reduced profit.

The chart shows how setup costs affect the total cost per piece. with a lot size of about 550 pieces setup represents 3% of direct cost and begins to affect total cost. At lots of 55 units, setup adds 30% to the direct cost and will require a significant price increase.

Make-To-Order Reduced Setup

With a 90% reduction in setup cost, the lowest Direct Cost is still $5.00 but now the company can accept orders as low as 100 units without affecting profits or prices more than 3%. An order of five units would require a 30% increase to cover setup cost. This compares with a 420% increase required to cover the setup for five units in the original scenario.

Implications of This Analysis

The conventional approach of volume discounting is counterproductive in several ways. It encourages customers to order far more product than they may require. This adds a great deal of unpredictability to a customer's orders and does not serve the customer's needs. This is true even for high-volume customers. A steady flow of small or medium size orders is far more predictable that large intermittent orders and complicates scheduling.

The ability to deliver exactly what a customer needs, reliably can often lock in important customers if the competition cannot do the same. It may also command a higher base price and increase profits.

The ability to satisfy small orders with no penalties may open entirely new markets for a product that could not be effectively addressed without this ability. Or it can deepen penetration of a small-order segment promoting both growth and profitability.

■ ■ ■ ■ ■ ■ ■